Business Insurance: The real cost of 'doing it yourself'.

Whether it's for your car, home, holiday or business; there's no shortage of insurance options available through online price comparison websites. Most people stick in their details and hit go on the cheapest quote, without much thought. The truth is that most won't realise that they don't have suitable cover until they need to make a claim, at which point it's too late. Insurance can be complicated which is why it's really important to know what to look out for before handing over your premium.

Always

Check

The documents.

Most insurance quotes will come with a summary document that provides a brief overview of the type of coverage offered and what you're covered for. This can be a useful indication as to whether the policy is suitable. Don't rely on this alone though. Always dig a little deeper into the policy wording to find out if you're actually covered for all eventualities.

I recently took a trip to the USA and needed travel insurance to cover me and my family whilst on our travels. I used a price comparison website and the cheapest quote was much less than the one I ended up selecting. On the face of it, this cheap policy had everything I needed, but once I read through the wording I noticed that the maximum amount (limit) that the insurer would pay out if our travel was delayed was £1,000 (which was actually £850 after my excess had been taken) and this wouldn't have been enough to cover the cost of last-minute accommodation, flights and any additional out of pocket expenses for three of us.

Given the legal and technical complexities of insurance, policy wordings are usually quite long and wordy. After all, this is a legal contract between you and the insurer. Whatever type of policy you're looking at, it's still worth taking the time to read through your documents to ensure that the important factors are covered and that the amount you'll be paid in the event of a claim matches up the amount you'd be out of pocket by.

It's one thing to be caught out when dealing with personal insurance (like home, motor and travel) but when arranging insurance for your business, there is far more at stake. The wrong cover could spell disaster. All businesses are different and it’s therefore important to make sure that the insurance you choose is tailored to your unique needs.

If you're responsible for finding insurance for your business (if you have employees, this is a legal requirement), then we'd strongly recommend using a registered insurance broker who specialises in commercial insurance. Why? Brokers know how to read policy wordings and are aware of the common pitfalls. They have a duty to make sure the coverage matches your requirements and unlike price comparison websites, brokers focus on quality of cover over price (although they'll still find you a good deal). Their job is to do all of the running around for you. In most cases, using a broker shouldn't cost you any extra as most are paid in the form of commission, directly from the insurer.

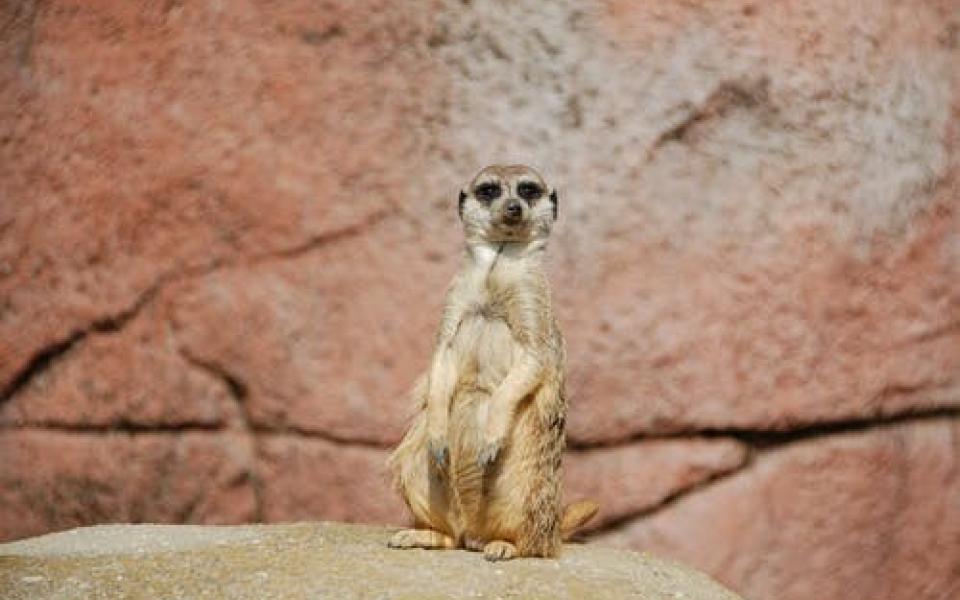

We work closely with insurance brokers and we've noticed a common link. They LOVE to help their clients. They get a real kick out of providing first-class, personal service. We can't say the same about a certain 'meerkat'.

If you don't yet use a broker, consider contacting one before your policy renewal. You can find a registered commercial insurance broker via the BIBA website: https://insurance.biba.org.uk/find-insurance

...