Introducing: Linked Contacts

In the fast-evolving landscape of insurance, staying ahead of the curve is imperative. The art of building and nurturing client relationships lies at the heart of a successful insurance brokerage business. As the industry continues to grow in complexity, the need for innovative solutions becomes more pressing. Enter BrokerCentral, the pioneering CRM and policy management system for insurance brokers, which has just rolled out an ingenious feature that promises to revolutionise the way brokers perceive their clients: the Shared Contacts feature.

Seeing Beyond Boundaries: The Shared Contacts Revolution

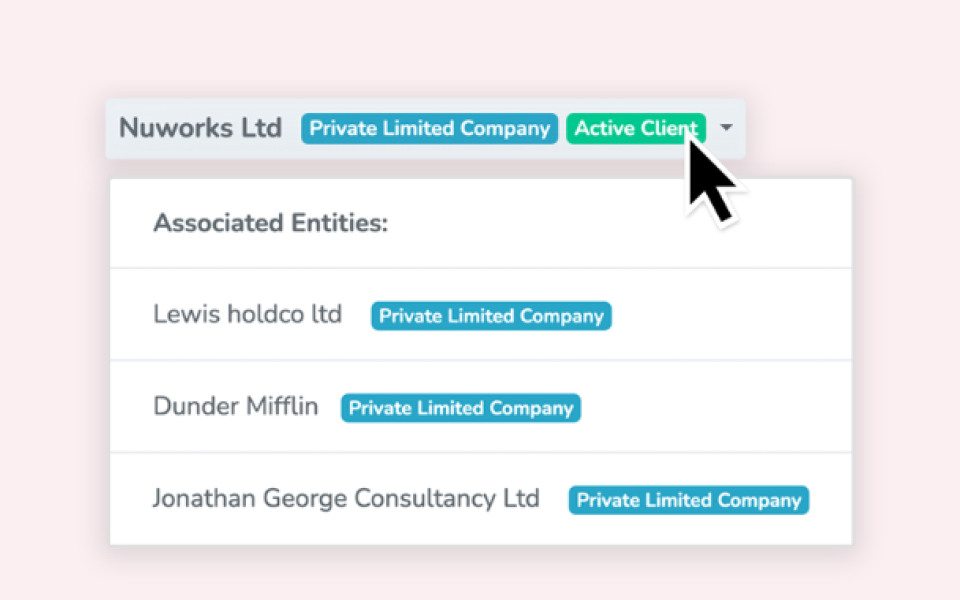

Gone are the days of viewing clients in isolated silos. With the advent of BrokerCentral's Shared Contacts feature, insurance brokers now have a powerful tool to effortlessly identify shared contacts across multiple client businesses. This feature empowers brokers to truly see the bigger picture of their clients' networks, enabling them to forge deeper connections, optimise cross-selling opportunities, and ultimately drive higher customer satisfaction and business growth.

The Importance of Seeing the Bigger Picture

Understanding a client's needs and preferences is essential in providing tailored insurance solutions. However, these individual pieces of information may not always tell the whole story. Often, clients from different industries or businesses may have overlapping relationships, suppliers, partners, or collaborators. Failing to identify these interconnections can lead to missed opportunities and an incomplete understanding of your client's risk profile.

Here's where the Shared Contacts feature shines:

Holistic Client Profiles: With the Shared Contacts feature, BrokerCentral users can easily consolidate contacts that are shared among multiple client businesses. This consolidated view provides brokers with a comprehensive understanding of the entire network of relationships, enabling them to deliver more personalised and relevant services.

Enhanced Cross-Selling: Recognising shared contacts among different clients opens doors to cross-selling opportunities that may have otherwise gone unnoticed. Brokers can suggest comprehensive insurance packages that cover a wider spectrum of needs, demonstrating a proactive approach that clients truly value.

Efficient Communication: In the complex world of insurance brokerage, effective communication is key. Knowing shared contacts helps brokers establish common ground and facilitates more engaging conversations. Clients feel understood and valued when brokers can intelligently discuss mutual connections, thereby building trust and rapport.

Risk Assessment and Mitigation: By understanding shared contacts, brokers can better assess potential risks and opportunities associated with those relationships. This deeper analysis equips brokers with the insights needed to tailor policies that adequately cover emerging challenges.

Client-Centric Approach: The Shared Contacts feature underscores a broker's commitment to being client-centric. When clients realise that their broker comprehends their broader network, they are more likely to remain loyal and even advocate for the broker within their circle.

Elevating the Broker-Client Relationship

BrokerCentral's Shared Contacts feature is a game-changer, aligning with the modern insurance brokerage industry's trajectory towards a more connected, personalised, and value-driven approach. By unveiling the bigger picture of clients and their networks, brokers can transcend the transactional and become trusted advisors who cater to the nuanced needs of today's diverse businesses.

As the insurance landscape continues to evolve, innovation like this propels the industry forward. BrokerCentral's Shared Contacts feature isn't just about contacts; it's about connection, comprehension, and community-building—a triumphant stride towards a brighter, more secure future for both clients and brokers alike. So, embrace the power of the bigger picture, and let BrokerCentral lead you to a realm of expanded possibilities.